do travel nurses pay state taxes

Jan 27 2022. First your home state will tax all income earned everywhere regardless of source.

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

It is also the most important since the determination of whether per diems.

. They also split the latter two taxes often called FICA 5050 with you you pay 765 they pay 765. This is the most common Tax Questions of Travel Nurses we receive all year. Make sure you qualify for all non-taxed per.

The following nine tips can make filing your travel nurse taxes easier save you money and help you avoid future tax liability. If employee they are obligated to deduct state taxes where you work. 1099 employees expecting to owe.

Workplace Enterprise Fintech China Policy Newsletters Braintrust wifey blowjob video Events Careers steel beams for sale craigslist near Kansas City MO. What taxes do travel nurses pay. Other benefits can include pre-tax benefits like health insurance and retirement plans.

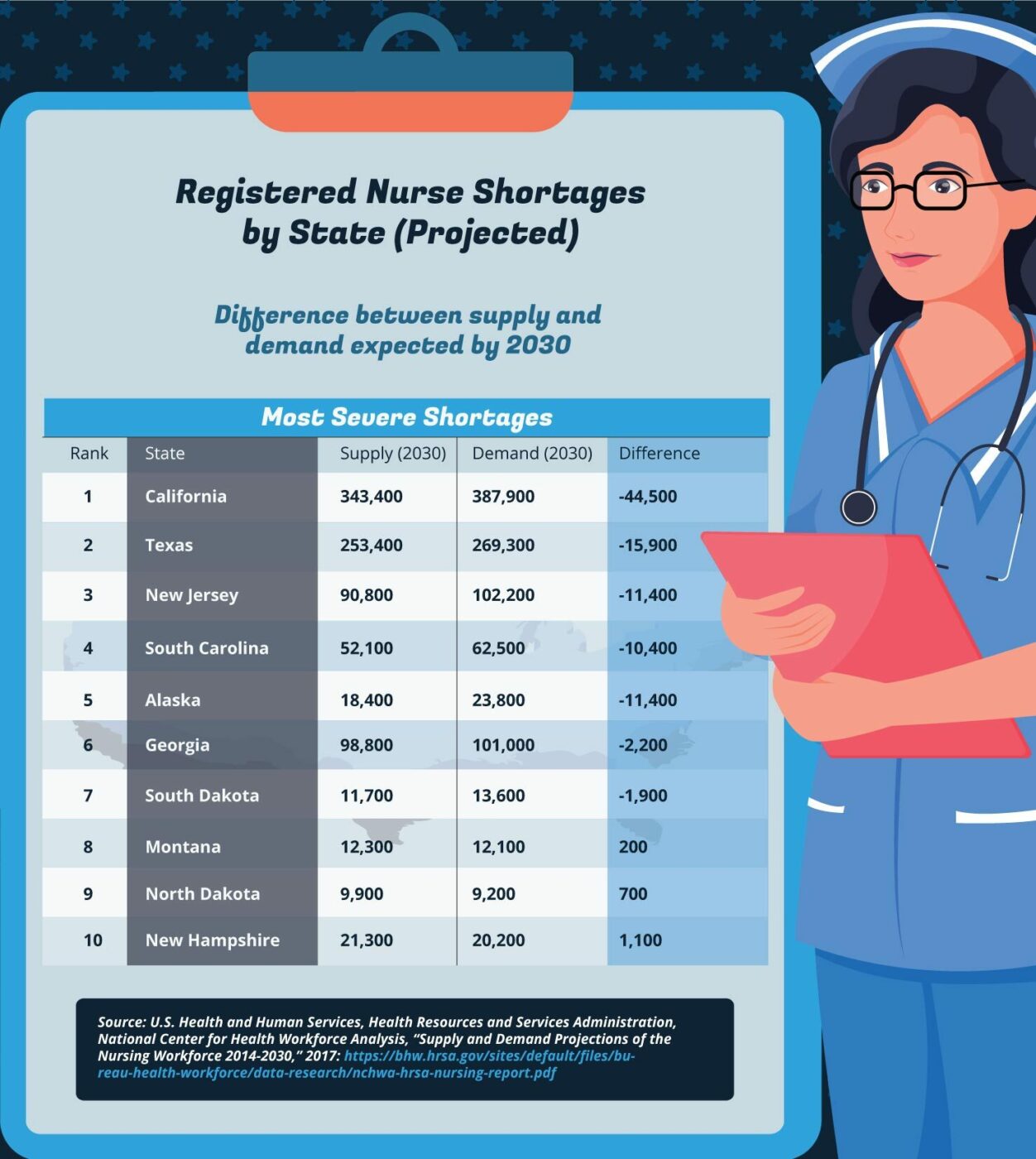

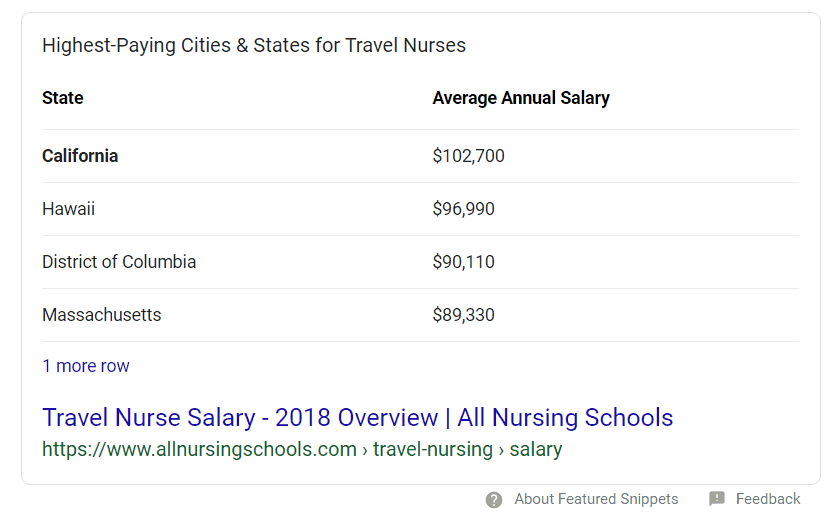

Expand Your Nursing Career. Luxembourg - 91000 USD Currently topping the list as the highest-paid country in the world for nurses this tiny country in Western Europe pays its nurses very well. This is because travel nurses are paid a base hourly rate that is taxable and a weekly travel stipend that is not taxable both of which equal their total pay in a given.

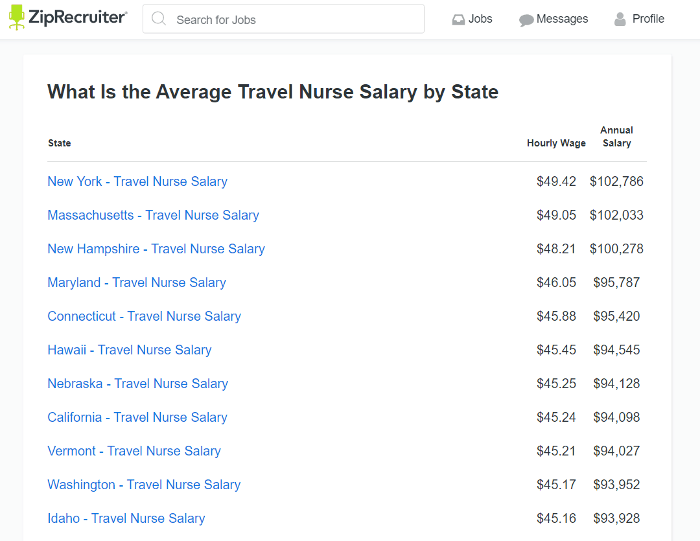

MAS Medical Staffing was founded with a mission to be a resource for per diem professionals and the facilities that need them. You will pay state income taxes in whichever state you work. Speak to a recruiter today.

Deciphering the travel nursing pay structure can be complicated. Not just at tax time. Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem.

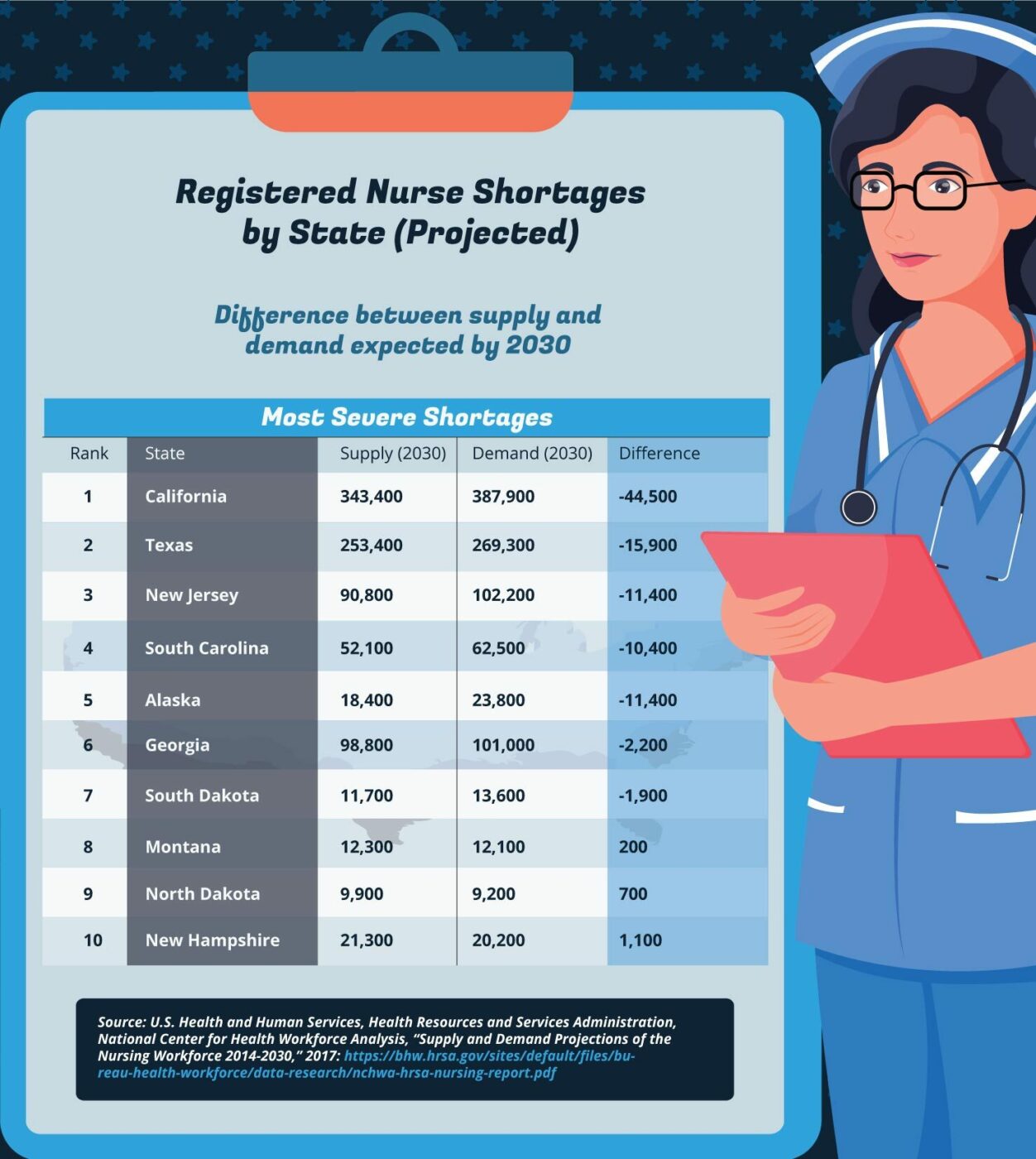

You may need to pay four taxes as an independent contractor. RNs can earn up to 2300 per week as a travel nurse. Federal income taxes according to your tax bracket.

In this Travel Nursing Tax Guide we will cover. The fact that the income was not earned in the home state is. State travel tax for Travel Nurses.

Two basic principles are at work here. Basically only income earned in California is taxed there. But many states including California use a percentage based approach to figuring.

There is no possibility of negotiating a higher bill rate based on a particular travel nurses salary history or work experience. Are you an employee W2 or contractor 1099 for the agency. Joseph Smith EAMS Tax an international taxation.

Travel nurses therefore have the financial advantage. For more on how state income tax impacts travel nurse salary seek the advice of a tax professional who is familiar with filing state income taxes for travel healthcare professionals. Travel Nurse Tax Deductions such as Tax-Free Stipends and Reimbursements Tax Homes Reasons for Taxable Income and Tips to pay less.

Receipts for any actuals for lodging if not getting it per diem as a stipend The employee must file the expense report with the employer within a reasonable period of time 60 days. Make sure to check state laws as you may end up paying state. Here When You Need Us.

As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees. Where do travel nurses pay state income taxes. For travelers stipends are tax-free when they are used to cover duplicated expenses such as lodging and meals and do not have to be reported as taxable income.

Typically Travel Nurses receive a lower base pay than permanent Pros with the difference made up by non-taxable reimbursements. Travel nurse income breakdown Travel nurses are paid differently than staff nurses because they receive. Prestigious Facilities with Best-in-Class Benefits.

Because of the tiny. We bridge gaps by offering real opportunities for healthcare. Ad TNAA has Experts in Housing Payroll Clinical Care.

If contractor its your responsibility to make estimated.

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Nurse Salary American Traveler

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

State Tax Questions American Traveler

How To Make The Most Money As A Travel Nurse

Travel Nurse Tax Faq With The Founder Of Travel Tax Youtube

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

Understanding Pay Packages For Traveling Nurses 2021 Marvel Medical Staffing

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How Much Do Travel Nurses Make Factors That Stack On The Cash

Taxes As A Travel Nurse Ethos Medical Staffing

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

What Is Travel Nursing Academia Labs